How One Developer Increased Return on Cost —Without Cutting Quality

CASE STUDY: 150-UNIT BUILD-TO-RENT PROJECT IN NORTH TEXAS

| Metric | Before Strella | After Strella |

|---|---|---|

| Total Development Cost | $30M | $28.43 |

| Material Savings | - | $1.57M (5.2) |

| Stabilized NOI | $1.50M | $1.50M |

| Yield On Cost (ROC) | 5.00% | 5.26% |

1. OVERVIEW

A build-to-rent (BTR) developer was preparing to construct a 150-unit horizontal rental community, with each home budgeted at $200K, resulting in a $30M total development cost.

The original pro forma projected $1.5M stabilized NOI, equating to a 5.00% Yield on Cost (YoC).

The developer engaged Strella Companies to identify cost efficiencies without reducing specification levels or delaying schedule.

2. SAVING OPPORTUNITIES IDENTIFIED

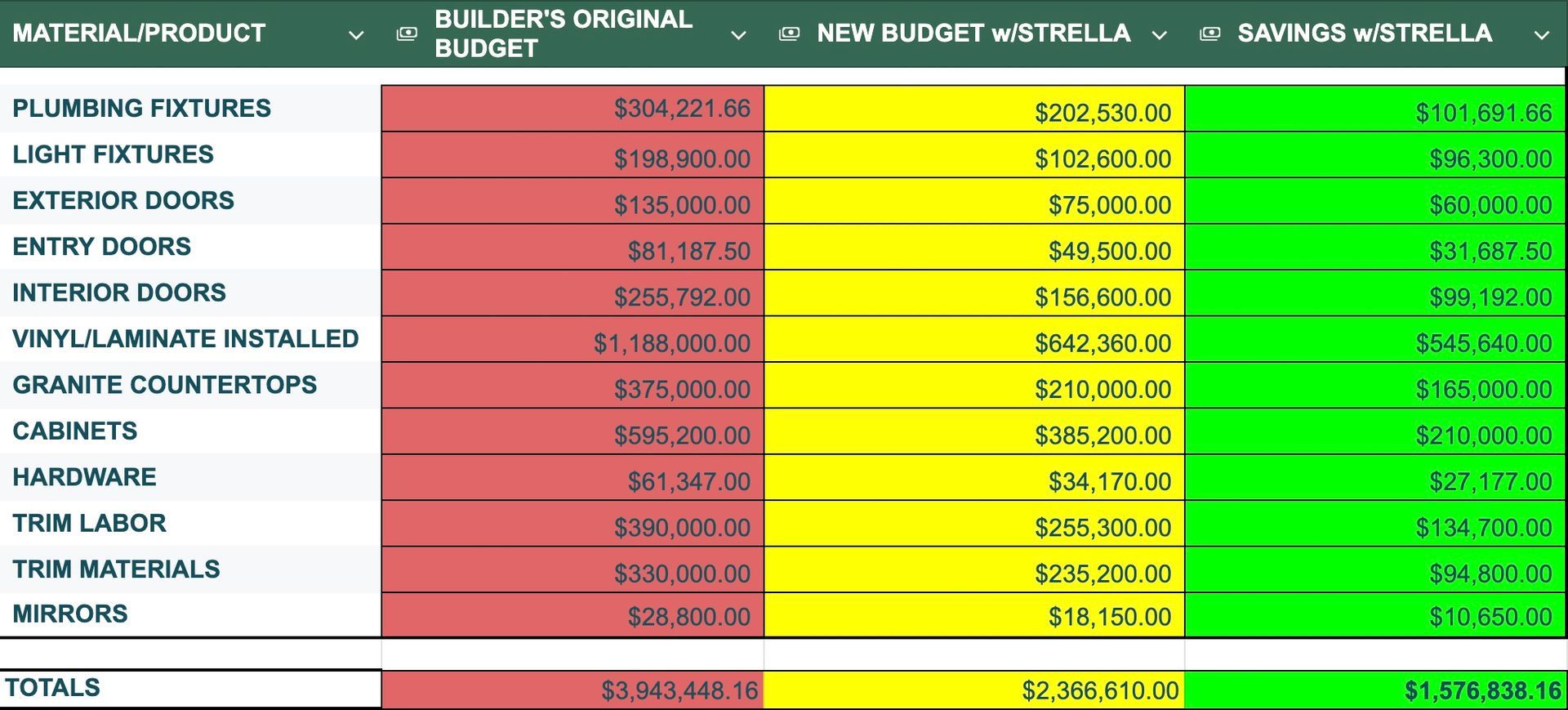

Strella conducted a line-item review of finish materials and identified over $10,000 per unit in procurement inefficiencies across:

- Cabinets

- Countertops

- Flooring

- Doors & Windows (interior & exterior)

- Light Fixtures

- Plumbing Fixtures (sinks, faucets, toilets, bath)

- Trim, Shelving, and Hardware

- Mirrors and Window Treatments

These savings were not design downgrades — they were achieved by buying smarter, not cheaper.

3. STRELLA SOLUTION

Strella delivered a factory-direct sourcing and logistics package, including:

- Direct-to-developer pricing — eliminating distributor and subcontractor markups

- End-to-end supply chain execution — production, shipping, warehousing, and site delivery

- Tariff mitigation strategies

- Guaranteed lead times and material availability

- Warranty-backed products equal or superior to original specs

- Optional turnkey labor for select categories

All pricing was

dropped directly into the developer’s budget models, enabling

apples-to-apples comparison with existing costs.

4. FINANCIAL IMPACT

Strella reduced total development cost by $1.57M, improving Yield on Cost from 5.00% to 5.26% — a 26 bps lift without touching rents.

CAPITAL STACK IMPACT

Strella’s budget reduction not only improved project returns — it

reduced both debt burden and equity required.

Assuming a typical 75% Loan-to-Cost capital structure:

| Component | Before | After | Impact |

|---|---|---|---|

| Total Development Cost | $30.0M | $28.43M | $1.57M less capital required |

| Loan Amount (75% LTC) | $22.5M | $21.32M | $1.2M less long-term debt |

| Equity Required (25%) | $7.5M | $7.11M | $375K less equity out of pocket |

Less debt to service. Less equity at risk. Same rental income. Higher return on cost.

WHY IT MATTERS

| Outcome | Impact |

|---|---|

| Higher Yield on Cost (YoC) | Stronger project-level return without increasing rents |

| Improved equity efficiency | Less capital is required to hit the same NOI — boosting equity IRR and multiple |

| Better lending optics | Lower basis improves DSCR and LTC/LTV, enhancing loan sizing and approval confidence |

| Enhanced exit valuation | A 26 bps yield improvement today compounds into millions in added value at disposition |

| Design & scope flexibility | Developer can bank the savings or reinvest into higher specs |

BY THE NUMBERS

$1.57M in construction savings = +26 bps YOC improvement = millions in long-term value creation. This is not cost-cutting — it’s capital efficiency.

Strella helped the developer deliver the same rental performance — but at a lower cost basis — resulting in a higher return on cost.

Want to increase your yield?

Put the risk-free PROFITFINDER program to work on your next project - or cycle of projects.

Rising costs don’t have to define your project’s returns. Our expert

team is ready to review your current budgets to uncover hidden

savings – because remember, “Where there’s mystery, there’s

money!”

Contact Strella today and put PROFITFINDER to work.